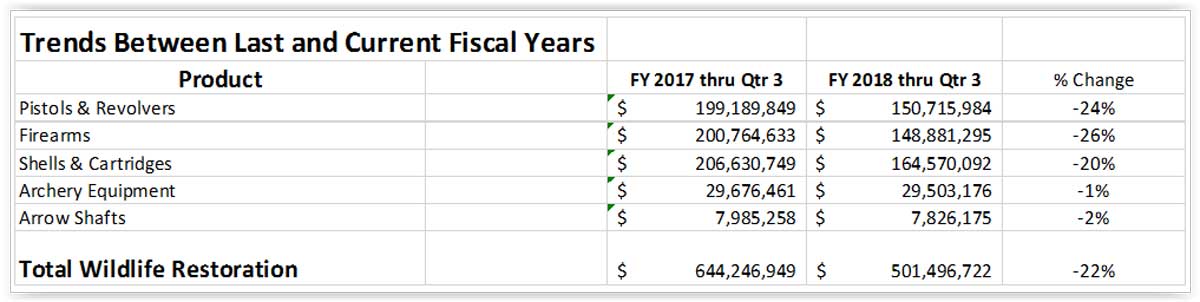

The Wildlife Management Institute reports that revenue generated from the sale of guns, ammunition and archery equipment is down 22 percent from one year earlier. That means the excise tax funding generated from those purchases, which is put back on the ground for conservation, is down that same amount.

Funding raised through the third quarter of Fiscal Year 2018 totaled $501,496,722 compared to Fiscal Year 2017 that totaled $644,246,949. The 22 percent decline is better than just three months earlier when the decline totaled 30 percent.

The drop also does not bode well for state wildlife agency funding.

On the flip side, funding generated via the sale of fishing equipment, motorboat fuel tax and small engine fuel tax increased nine percent to $459,847,435.

Go here for a closer look at the numbers.

(Graphic source: Wildlife Management Institute)